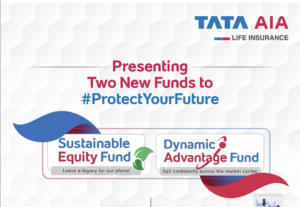

Mumbai, March 22, 2023: Tata AIA Life Insurance (Tata AIA) has launched, NFOs under the aegis of #ProtectYourFuture.

Mumbai, March 22, 2023: Tata AIA Life Insurance (Tata AIA) has launched, NFOs under the aegis of #ProtectYourFuture.

- Sustainable Equity Fund &

- Dynamic Advantage Fund

at NAV of Rs. 10 per unit.

Tata AIA’s Sustainability Equity Fund seeks to generate capital appreciation in the long term by investing in companies that adopt sustainable or Environmental, Social and Governance (ESG) friendly practices. The fund will invest 80-100% in equity and equity related instruments following ESG criteria. and upto20% in other equities or debt or money market instruments. Demonstrating the fund’s core philosophy, Tata AIA will plant a sapling that will be geo-tagged and provide a digital certificate of the same to every policy holder, investing in this fund.

Tata AIA’s Dynamic Advantage Fund aims to generate superior and steady returns, despite factors like market volatility. The fund will dynamically allocate the investment corpus between Equity and Debt depending upon market conditions.

Investments in the two NFOs can be made through Tata AIA’s ULIP offerings like Fortune Pro, Wealth Pro, Fortune Maxima and Wealth Maxima. Consumers can also avail this opportunity by purchasing Tata AIA’s unique investment linked protection solutions, Param Rakshak and Sampoorna Raksha Supreme. Consumers can thus benefit from market linked returns, while securing their loved ones with the protection of a life insurance cover.

Harshad Patil, Executive Vice President and Chief Investment Officer (CIO), Tata AIA Life Insurance, said, “Protecting our future is crucial in these times of volatility and economic uncertainty. At the same time, we are witnessing significant climatic changes, clearly revealing the negative impact of rapid urbanization and development on our planet. Keeping this in mind, we have come up with two unique NFOs that will enable investors to tide through these challenges while contributing to a better future of our planet.”

Sustainability is currently an important criterion for businesses when it comes to adopting sustainable or ESG friendly protocols. Apart from categories such as financial inclusion, Sustainable investing covers new age fields such as Electric Mobility, Robotics and Automation Information access etc. Many Infotech, Fintech and other firms are making rapid progress in these contemporary categories, offering exciting long term investment opportunities. From a consumer perspective, increasing social consciousness and environmental concerns are influencing their purchase decisions. According to Nielsen, 75% of Millennials are eco-conscious to the point of changing their buying habits to favor environmentally friendly products. 90% of Millennials are interested in pursuing sustainable investments. Thus, there exists great opportunity to create investments that allow individuals to truly embrace owning their financial futures and doing their bit for the environment.

The Tata group has been at the forefront of sustainability. In fact, it is ranked No.1 on sustainability across Asia in 2022 as per GlobeScan Sustainability Leaders Survey. **

When it comes to making consistent returns in the markets, it is important to remember that no asset class outperforms others at all times. Hence it is very important that one diversifies the investments and leaves the job of allocating funds amid market volatility to professional fund managers with business cycles getting shorter and markets reacting to various events, a dynamic asset allocation fund can help generate consistent returns across market cycles.

“The Dynamic Advantage Fund aims to provide investors returns despite volatile market conditions. It will do so by dynamically investing in a combination of equity and debt avenues. Investors can thus benefit from the growth potential of equity, while benefiting from the downside protection that debt funds investments offer. Investors no longer need to closely track the markets and rebalance their portfolio manually, a task nearly impossible given the sharp and regular market movements.” Harshad added.

Tata AIA has a well-defined research process and methodology and takes a long-term view based on fundamental research. It follows a robust investment philosophy of portfolio construction through bottom-up stock selection by focusing on companies with sustainable earnings growth. Further, the investment team has been quite stable and has stayed with the company for long, ensuring a consistent investment approach. This has generated consistent risk-adjusted investment returns to meet investors’ long-term objectives and return expectations.

The below table showcases the performance of existing equity funds of Tata AIA since inception in comparison to the benchmark returns.

| 5-year returns | Since inception returns | ||||

| TATA AIA Funds | Morningstar

Ratings# |

Fund returns (%) * | Benchmark returns (%) * | Fund returns (%) * | Benchmark returns (%) * |

| Multi Cap Fund | 5 Star | 21.05 | 12.39 | 20.77 | 12.80 |

| Top 200 Fund | 5 Star | 19.10 | 12.39 | 18.33 | 15.54 |

| Whole Life Mid Cap Equity Fund | 5 Star | 12.63 | 10.00 | 14.63 | 12.30 |

*Data as on 30 November,2022. # Morningstar ratings as of 31st October 2022 on an overall basis

**Inception dates: Whole Life Midcap Equity Fund: 10 Jan 2007, Top 200 Fund: 12 Jan 2009, Multi Cap Fund: 5 Oct 2015

In addition to the impressive track record of its existing funds, Tata AIA’s ULIP funds have been rated very highly by fund trackers. 99% of the rated AUM of Tata AIA is rated either 4 star or 5 star on a 5-year basis as of March 31st, 2022, by Morningstar Rating*. Tata AIA Life had a total Assets Under Management (AUM) of INR 69286 crore as of 28th February 2023.